Epiroc interim report Q2 2023

Epiroc has released its Q2 interim report, please find below the highlights as detailed by the company together with the comments from the CEO. A full copy of the report is available from the link at the bottom of the comments.

• Orders received increased 15% to MSEK 15 436 (13 377), supported by acquisitions. The organic decline was -1%.

• Revenues increased 34% to MSEK 15 910 (11 868), organic increase of 17%.

• Operating profit increased 43% to MSEK 3 413 (2 381), including items affecting comparability of MSEK -16 (-420).*

• Operating margin was 21.5% (20.1), and the adjusted operating margin was 21.6% (23.6).

• Basic earnings per share were SEK 2.19 (1.47).

• Operating cash flow was MSEK 1 549 (1 462).

• One acquisition completed in the quarter that strengthens the offering within low-profile underground equipment.**

CEO comments

Record quarter

The order intake increased by 15% to record-high MSEK 15 436, with strong contribution from acquisitions. The customer activity remained high, especially in mining. We won several large equipment orders, albeit not at the same high level as in Q2 last year. The service business continued to perform well, supported by larger rebuilds of customers’ equipment.

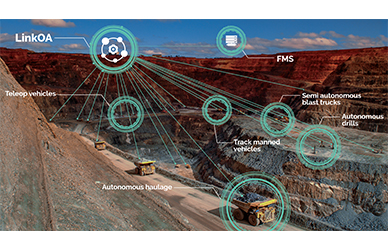

In the near term, we expect that the underlying demand, both for equipment and aftermarket, will remain at a high level. Our revenues increased 34% to record-high MSEK 15 910, driven by organic growth, particularly for equipment, as well as from acquisitions. I am pleased to see that our recent acquisitions have achieved higher revenues than anticipated. We had an especially strong development for automation solutions. The operating profit, EBIT, increased by 43% to MSEK 3 413. The adjusted operating margin was 21.6% (23.6), with strong organic contribution, while currency and acquisitions impacted negatively. The dilution from acquisitions was 0.9 percentage points on the Group margin.

Cash flow

The operating cash flow increased to MSEK 1 549 (1 462). The long period of strong growth and higher equipment volumes in combination with supply-chain challenges, mainly for outbound transport, led to higher working capital, particularly in inventory. We are taking measures to optimize and reduce inventories and expect that inventory ratios will improve throughout the year.

Eventful quarter

The “Epiroc World Expo”, which we hosted in May in Örebro, Sweden, gathered almost 200 customers from 25 countries. During the week, we showcased innovations and solutions that will increase productivity and enhance sustainability for our customers. In conjunction with the event, we also hosted our Capital Markets Day, with more than 100 external guests.

Climate leader

In an annual ranking of 500 companies conducted by the Financial Times, Epiroc was named a “Europe Climate Leader” and came out among the top one-third of the companies. Epiroc was highest ranked among the Sweden-based companies in the "Machines & industrial equipment" category. Climate is important both to us and to our customers. We invest more than ever in innovation to keep providing customers with equipment and services that increase productivity as well as reduce emissions. Year-on-year, our R&D expenses are up almost 40% to MSEK 500.

Long track record of profitable growth

While our roots trace back 150 years to 1873, in June, we celebrated our fifth birthday as a stand-alone company. We have several milestones to be proud of. We have successfully established the Epiroc brand, innovation is thriving, we have set ambitious sustainability goals for 2030 - which have been validated as science based targets - and we launched our new vision, Dare to think new.

In Q2 2018, our rolling twelve months revenues were BSEK 34 and now, we are at BSEK 57. This corresponds to an increase of 65% and an annual growth rate of 11%. At the same time, our adjusted EBIT has grown even more, almost doubling from BSEK 6.7 to BSEK 13.0, corresponding to an annual growth rate of 14%. That is a strong achievement that we can be proud of.

The best is yet to come

As a team, we have demonstrated great strength and resilience amid major and unforeseen challenges during the past years. Automation, digitalization, and electrification are transforming the industry, but it is the people that actually make it happen. At Epiroc, we have more than 18 000 passionate colleagues who share a relentless ambition to bring value to our customers - not only today, but also in the future. Seeing their drive, I am certain that the best is yet to come.

Helena Hedblom, President and CEO

For more information

Categories: BEV - Battery Electric Vehicles Drilling - Equipment and Supplies Load Haul Dump Vehicles Loaders - Underground

2023-07-20 | Epiroc | Sweden | Views 1984